It should be clear that the rumble of an idling semi-truck was once the steady beat of the global economy. So, as a matter of fact, there was a constant hum carrying goods from port to warehouse, from farm to table. However, for many years, until now in 2025, that hum has faltered, replaced by a growing silence on the highways. Sounds a bit poetic, but many of you already know that the numbers from a few years ago now seem like a grim prologue.

The latest report from the IRU suggests that the 2.6 million unfilled truck driver jobs in 2021 were a warning. Now, in 2025, that number feels like a prophecy. Economic pressures have turned what was once a chronic shortage into a full-blown crisis, and the once-steady rhythm of global commerce is faltering.

Companies are scrambling for solutions. Some are offering massive sign-on bonuses, hoping to lure drivers with a one-time cash injection. Others are investing in new technology, from advanced driver-assistance systems that make the job safer to apps that allow drivers to better manage their routes and home time.

Let's take a look at what we have to offer in our article on this ongoing topic. How companies are managing staff shortage and where that is going in such circumstances.

Why is there a shortage of truck drivers?

The trucking industry is the backbone of commerce, moving goods across cities, states, and countries. Yet, in recent years, a significant shortage of truck drivers has emerged, affecting supply chains and raising delivery costs. But why is this shortage happening?

Aging workforce. A large portion of the truck-driving workforce is nearing retirement age. According to industry data, the average age of a truck driver in the U.S. is over 46. With fewer young drivers entering the profession, the gap between retiring drivers and new recruits widens.

Lifestyle challenges. Long hours on the road, extended time away from home, and irregular schedules make trucking a demanding career. Many potential drivers are deterred by the lifestyle, especially younger workers seeking a better work-life balance.

Regulatory and licensing hurdles. Obtaining a commercial driver’s license (CDL) requires training, testing, and meeting strict safety regulations. While necessary for safety concerns, these hurdles can delay entry into the profession and discourage someone from pursuing it.

Economic and industry pressures. Trucking can be physically and mentally taxing, yet driver wages and benefits may not always match the demands of the job. Inconsistent pay, especially for long-haul routes, can push drivers to leave or avoid the industry altogether.

Pandemic-related disruptions. The COVID-19 pandemic exacerbated the shortage. Many drivers retired early, while new entrants faced delays in training programs. Additionally, increased e-commerce demand placed more pressure on an already strained workforce.

Perception and recruitment challenges. Trucking is often perceived as a less appealing career path. Combined with a lack of effective recruitment campaigns, this perception limits the inflow of new talent.

Addressing the truck driver shortage will require a multi-faceted approach, like improving working conditions, offering competitive pay, modernizing training, and promoting trucking as a viable career choice. Without these changes, supply chain disruptions and rising costs may continue impacting businesses and consumers.

How dire is the truck driver shortage?

The hum of engines on the highway has always been the heartbeat of the modern economy. However, in recent years, in certain parts of the world, that hum has grown quieter. We see fewer drivers, a shortage that even big trucking companies struggle with. You can feel it in the air, a strange, unsettling stillness. Well, it is what it is, but we are all worrying about it. For a moment, it feels like the great crisis has passed. But this isn't a sign of recovery, it's the quiet of a deep breath before the final plunge.

Work conditions and work-life balance are very significant with increased demand and a visible trucker shortage. We also see that operating costs are rising, and many drivers want to increase pay. They see a growing demand, which also impacts recruitment efforts. So, all owner operators are trying to overcome the shortage by searching for potential drivers in the Far East. They can still work for low wages and don't need to cope with other factors that put greater strain on today's US and EU countries.

Despite a decrease in transportation demand in some areas, the truck driver shortage persists. According to a recent report, 3 million truck driver positions are unfilled in the countries studied as of 2024, which represents 7% of the total available positions. The report also notes that between 55% and 75% of trucking companies in most countries face severe or very severe difficulty finding qualified drivers. Well, something needs to be said here about driverless trucks. It looks like they won't impact the trucking industry in the coming years, but without a doubt, you don't have to improve working conditions or get more young people if you use self-driving trucks.

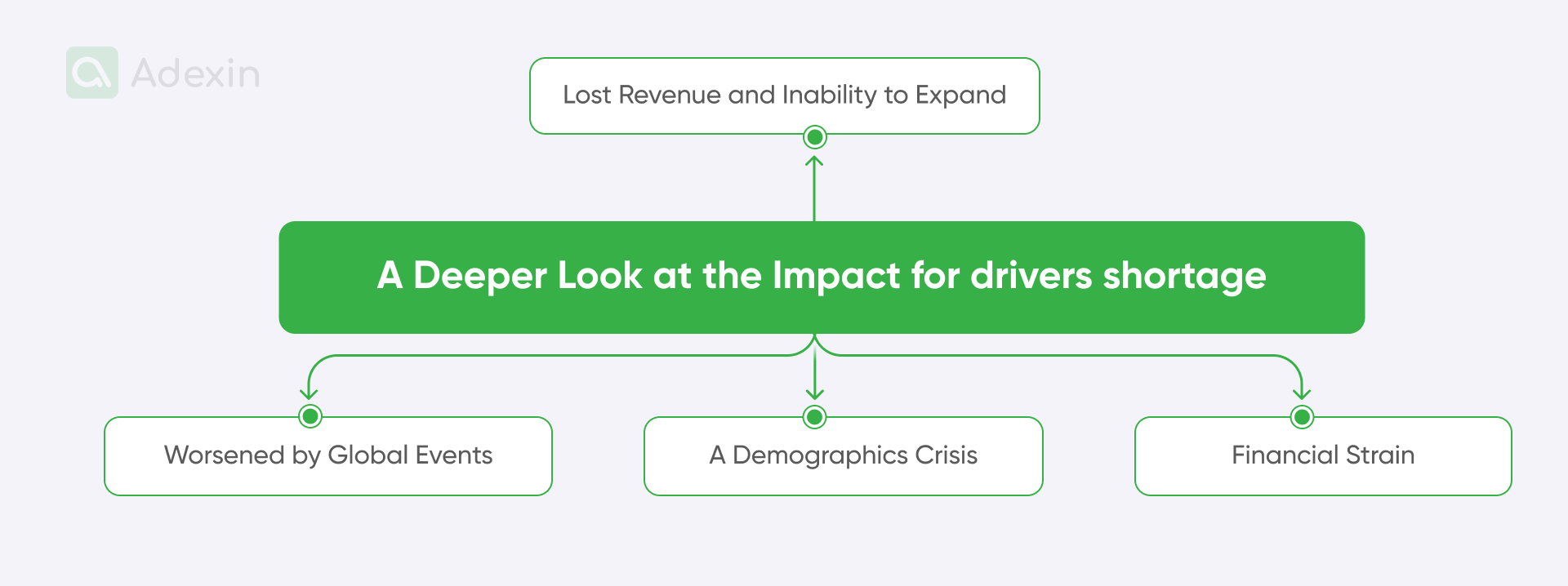

The consequences of the truck driver shortage are far-reaching and affect more than just the transportation industry itself:

Lost revenue and inability to expand. Many transport companies cannot expand their businesses or even lose existing clients because they don't have enough drivers to meet demand.

Worsened by global events. The war in Ukraine, for example, has exacerbated the shortage in Europe by removing a large number of Ukrainian, Belarusian, and Russian drivers from the workforce.

A demographics crisis. The trucking profession has an aging population, with a significant percentage of drivers over the age of 55. In Europe, only about 5% of drivers are under 25, while a retirement cliff looms for a large portion of the workforce.

Financial strain. Rising energy prices, persistent core inflation, and increasing interest rates have dampened consumption and investment, negatively impacting transportation demand and further squeezing carriers' profits.

Need help with custom software development for your transportation business?

Learn how we can help you

Explore moreHow to handle the truck driver shortage?

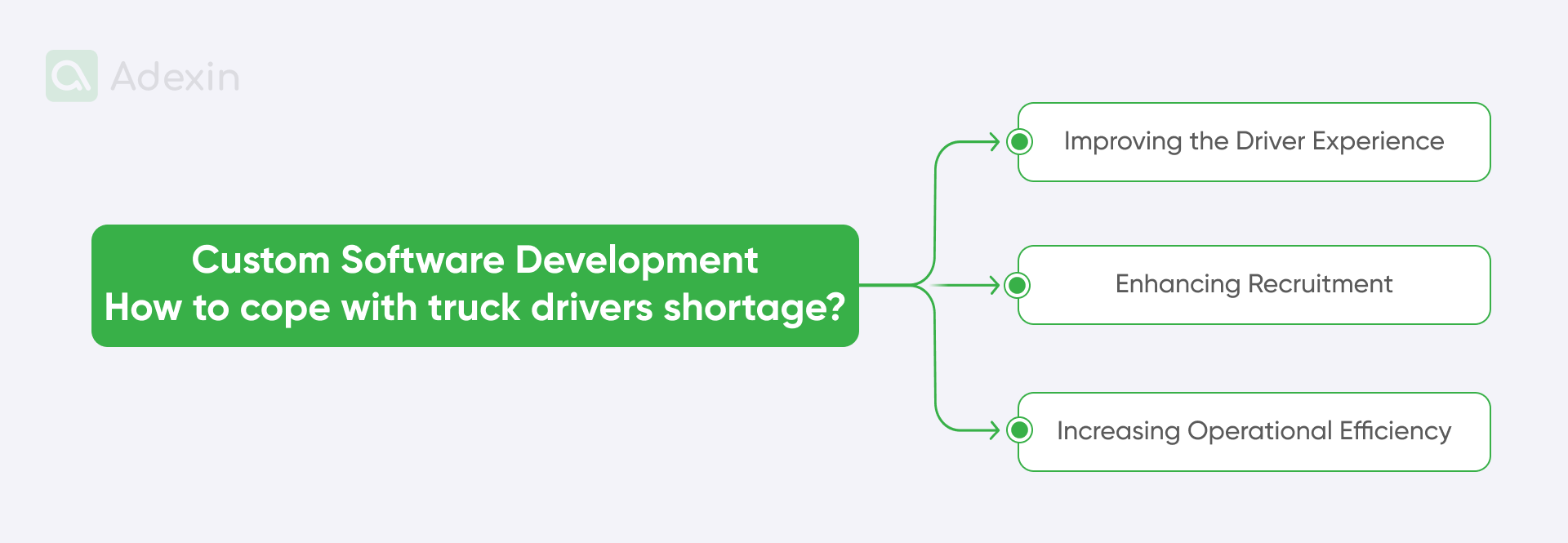

To address the truck driver shortage, the trucking industry must tackle the underlying issues of poor working conditions and inadequate pay, exacerbated by economic downturns. While traditional solutions, such as increasing wages and lowering the driving age, are essential, a more comprehensive approach involves leveraging technology, specifically custom software development.

Custom software development can provide crucial support to the trucking industry by tackling the main issues that contribute to the truck driver shortage. Instead of relying on a one-size-fits-all solution, custom-built applications can be tailored to address the unique needs of a specific company, improving operational efficiency and the overall driver experience.

Improving the driver experience. Custom applications can automate and streamline the administrative parts of a driver's job. So, for example, these might include managing bills of lading and other shipping documents.

Enhancing recruitment and training. Custom software can be developed to streamline the recruitment process. For example, AI-powered tools can screen candidates and identify qualified applicants more effectively. For training, companies can use custom virtual reality (VR) or simulation software to provide realistic, risk-free training environments.

Increasing operational efficiency. Transportation management systems (TMS) built with custom features can optimize driver utilization and improve overall logistics. Automated dispatch systems can assign routes based on a driver's availability and qualifications.

Addressing the driver shortage with digital approaches

According to industry reports, rising freight demand, an aging workforce, and difficulties in attracting younger drivers contribute to widening capacity gaps year over year. This shortage not only affects carriers’ ability to scale but also puts additional strain on existing drivers, leading to higher turnover and reduced service quality. Addressing the issue requires innovative technology-driven approaches that optimize productivity, enhance retention, and make the profession more appealing. Below, we outline three practical strategies for tackling driver scarcity, from fully custom solutions to hybrid and existing tools.

Fully custom solutions

A fully custom software solution can directly target the inefficiencies that drive dissatisfaction among truck drivers. By automating paperwork, streamlining communication, and optimizing route assignments, carriers can significantly improve driver experience and productivity. Adexin’s truck owners' assistance app exemplifies this approach. Built for logistics firms seeking to modernize driver operations, the app integrates in-app document scanning with edge detection and image correction, responsive route management, and seamless load communication. The result is a platform that minimizes administrative burden, maximizes road time, and supports better retention. While fully custom solutions deliver the strongest impact, they require higher upfront investment and longer development timelines.

Hybrid solutions

Hybrid approaches extend existing transport management systems (TMS) or enterprise platforms (ERP) with driver-focused features. Companies can add mobile document scanning, optimized load assignment, or real-time messaging without rebuilding core systems. This balances implementation speed with functional depth, enabling carriers to address critical driver shortages faster while preserving their current IT landscape. Hybrid solutions are cost-effective and flexible but require careful integration to avoid siloed data or fragmented workflows.

Existing solutions

Off-the-shelf tools provide a quick and affordable way to address the truck driver shortage. Mobile apps for document management, route planning, and basic communications can be deployed with minimal onboarding and training. These solutions offer immediate relief, reducing driver downtime and simplifying operations. However, they often lack advanced customization or scalability compared to hybrid and fully custom platforms. For organizations needing a long-term competitive edge, existing tools may serve best as a temporary measure.

The high cost of ignoring digital transformation in trucking

The trucking industry is under immense pressure from rising demand, supply chain disruptions, and an ongoing truck driver shortage. At the center of this challenge lies a clear truth that without adopting modern, custom-built software solutions, trucking businesses risk falling behind. What was once optional is now essential technology, and it is no longer a nice-to-have but the backbone of operational resilience and competitiveness.

Relying on manual processes or outdated, off-the-shelf systems creates a ripple effect of inefficiencies that threaten long-term growth:

Loss of competitive edge. Competitors already leveraging business AI automation, smart dispatching, and predictive analytics are achieving faster turnaround times and higher driver satisfaction. Falling behind in technology adoption means losing market share.

Driver dissatisfaction and attrition. Today’s workforce expects modern tools like mobile apps, real-time communication, and digital workflows. Without them, it becomes difficult to attract younger truck drivers or retain experienced ones.

Operational bottlenecks. Manual scheduling, fragmented communication, and inefficient route planning make scaling impossible. As demand fluctuates, these bottlenecks grow into costly breakdowns in service delivery.

Inability to adapt to market shifts. Volatile fuel prices, stricter regulations, and evolving customer expectations require agility. Businesses relying on outdated systems lack the visibility and flexibility to respond effectively.

Higher long-term costs. What feels like saving money by avoiding technology investments often translates into higher fuel usage, administrative overhead, and missed opportunities for optimization.

In contrast, trucking companies that embrace digital transformation gain measurable advantages. Custom trucking software empowers entrepreneurs to streamline dispatching, optimize route planning, enable real-time driver communication, and make data-driven decisions that support long-term resilience.

Technology-driven solutions are not just about efficiency, they are about survival. For trucking entrepreneurs, the choice is simple, adopt modern digital tools to remain competitive and future-ready, or risk stagnation, talent loss, and an unsustainable business model.

Are you in search of a reliable tech partner?

Adexin can help with advanced logistics solutions

Contact usFinal takeaway

The trucking industry’s driver shortage is not a temporary challenge but a structural crisis that requires bold solutions. Companies that rely solely on traditional fixes, such as higher pay, bonuses, or recruitment abroad, will find themselves continually playing catch-up. The real competitive edge lies in embracing digital transformation, where custom software solutions optimize operations, improve driver satisfaction, and secure long-term growth.

Look, it's time to start your digital transformation today. Don't just keep up with the competition, leave them behind. Contact our team today, and let's work together to find a solution.